You’re probably doing payroll wrong. If you’re using manual processes to pay your guides, then you’re definitely doing payroll wrong. According to Clutch, “25% of small businesses handle their finances on paper rather than a computer, and 45% don’t even have an in-house accountant or bookkeeper.”

Automating payroll management is critical when running an adventure tour business. If you want to keep your guides motivated and your operations running smoothly, you need accurate and timely payment to your staff.

Unfortunately, many tour operators still rely on manual payroll processes, which leads to errors, inefficiencies, and very unhappy guides. Let’s talk about some common ways tour operators mess up payroll management and how you can fix it through automation.

Making Errors and Being Inconsistent

When you manage payroll manually, you’re likely to mess up. You’re human, so it happens. From miscalculations to data entry mistakes, even the smallest error can have significant consequences on your guides, accounting, taxes. You name it.

Inaccurate paychecks frustrates your staff and damages your business’s reputation. In fact, the IRS collected over $1 billion dollars in penalties, like business’ “failure to pay,” which partly means not paying employees at all or paying them incorrectly.

Wasting Too Much Time On Payroll

Manual payroll management is time-consuming. It involves manually collecting timesheets, calculating wages, accounting for overtime, and handling tax deductions. “About one-third of small businesses surveyed spend more than six hours each month handling payroll internally,” states Oracle Netsuite.

These tasks take up valuable time that could be better spent on growing your tour operator business, improving customer experiences, or developing new adventure packages.

Not Staying On Top Of Payroll Legal Requirements

Tour operators, like all other businesses, are subject to legal and tax regulations when it comes to payroll management. Staying compliant with changing laws and regulations is challenging, especially when you’re doing it all manually, and trying to run the rest of your tour operations.

Failing to comply with these regulations can result in severe penalties, hefty fines, and reputational damage. According to the IRS, “In Fiscal Year (FY) 2022, the IRS collected more than $98.4 billion in unpaid assessments on returns filed with additional tax due, netting about $58.8 billion after credit transfers.” When you don’t know the laws or what you owe, you’re more likely to end up on the IRS’ naughty list.

When you’re not using an automated payroll systems, you’re missing out on features that keep you compliant, like automatic tax calculations and regular updates to stay up-to-date with legal requirements.

Lacking Transparency In Payroll

Manual payroll systems may lack transparency, which can lead to misunderstandings and disputes with your staff. According to Salary.com, “Only 23 percent of employees said their employer is transparent about how people are paid in their organization.” You may not be intentionally withholding payroll information from your staff, but you may inadvertently make your guides feel like things are as clear as they should be.

When pay calculations are not clearly communicated, your staff may feel undervalued, question the accuracy of their earnings, or even leave your guiding company. Automating payroll processes provides transparency by generating detailed pay stubs and allowing employees to access their payment information online. This fosters trust and minimizes potential conflicts.

Not Scaling Your Payroll With Your Business Growth

It’s awesome to see your business growing, but if you’re not scaling your payroll with your business, you’re going to be dealing with even more challenges. In fact, SCORE says, “40% of small business owners say bookkeeping and taxes are the worst and most time-consuming part of owning a business.”

The complexities of payroll, such as handling different payment structures, managing benefits, and tracking employee time, can become overwhelming.

Manual processes struggle to keep up with the demands of a growing workforce, and you end up making even more errors because there’s so much data to handle.

Wasting Money By Doing Payroll Manually

Although it may seem counterintuitive, manual payroll management can be more expensive than automating the process.

The time spent on manual calculations, resolving errors, and addressing payroll-related issues can add up quickly, so much so that you could lose entire days due to payroll issues. Additionally, the risk of non-compliance with tax and legal regulations can result in financial penalties.

Tour operators who rely on manual payroll management put their business at risk of errors, inefficiencies, compliance issues, and unhappy employees. So, if you’re doing payroll manually and want to avoid these pitfalls, what can you do instead?

Well, you can automate it.

By embracing automation you avoid these pitfalls and instead, see more accuracy, save time and money, stay compliant, be transparent, and scale with your growing business.

By automating your payroll processes, you can focus on what matters most— taking your guests on amazing adventures while ensuring your employees are paid accurately and on time. So, what can you do to automate your payroll? Let’s dive in deeper.

How To Automate Payroll As A Tour Operator

Like we’ve already mentioned, ensuring accurate and timely payment to your guides is essential in keep your staff happy and overall business operations. With payroll automation technology, you’ll save time, reduce errors, and be more productive.

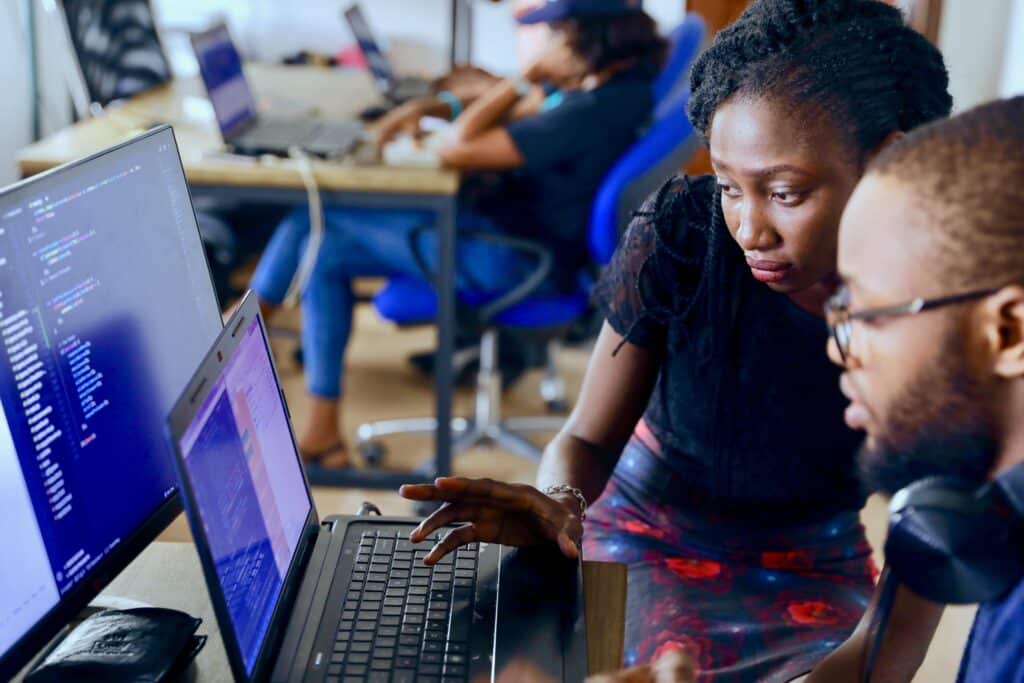

Select Payroll Software That Works For You

The first step in automating your payroll is to choose the right software that works for your tour operations. Look for software specifically designed for payroll management, preferably one that integrates with other tools such as time-tracking systems, accounting software, and HR management platforms.

You also have to comply with legal and tax regulations, so find payroll software that keeps you updated on changing laws and regulations. Look for software that automatically updates tax tables and adjusts calculations accordingly. This ensures compliance and minimizes the risk of penalties or fines.

Evaluate different options based on features, user-friendliness, cost, and customer reviews. The leading payroll software includes QuickBooks (psst…Origin integrates with Quickbooks), Gusto, and OnPay.

Centralize Your Staff’s Data In Your Chosen Software

Next, you need to consolidate all of your employee data into the payroll software you chose. This includes personal details, contract information, tax forms, and payment preferences. Sounds like a lot, but you only have to do this once and then update it yearly if things change.

By maintaining accurate and up-to-date information on your guides, you streamline the payroll process. You also reduce the chances of errors or discrepancies. Plus, it stops you from annoying your guides for this information every time you need to cut them a check.

Automate Guide Time Tracking, Payroll, And Deductions

Time Tracking and Payroll

For tour operators, tracking employee time can be challenging because of the varying schedules and remote work arrangements. Implementing an automated time tracking system can simplify the process significantly.

There are a ton of options to help automate time tracking. For instance, biometric devices, web-based timesheets, or mobile apps that allow employees to clock in and out, enter hours worked, and submit time-off requests. At Origin, we make it easy for you to track your guides’ work hours and time off too. Integrating this system with your payroll software will ensure accurate calculation of wages and overtime.

Taxes and Deductions

Another incredibly time-consuming aspect of payroll management is manually calculating wages, deductions, and taxes. With automation, you can eliminate this tedious task. You need to make sure your payroll software can handle complex calculations and support various payment structures. For example, hourly wages, commissions, bonuses, and allowances.

Additionally, the software should automatically factor in tax deductions and social security contributions.

Set Up Direct Deposit For Your Staff

Your fourth step is setting up direct deposit for your staff. It’ll save you time and simplify the payment process by transferring money directly into your staffs bank accounts. Thereby, eliminating paper checks or handling cash, which can be sketchy to do.

Your payroll software should integrate with banking systems to facilitate secure and timely transfers (don’t stress out your staff with unreliable pay timing). Finally, the payroll software should generate detailed pay stubs that your employees can access electronically, giving them a transparent breakdown of their earnings.

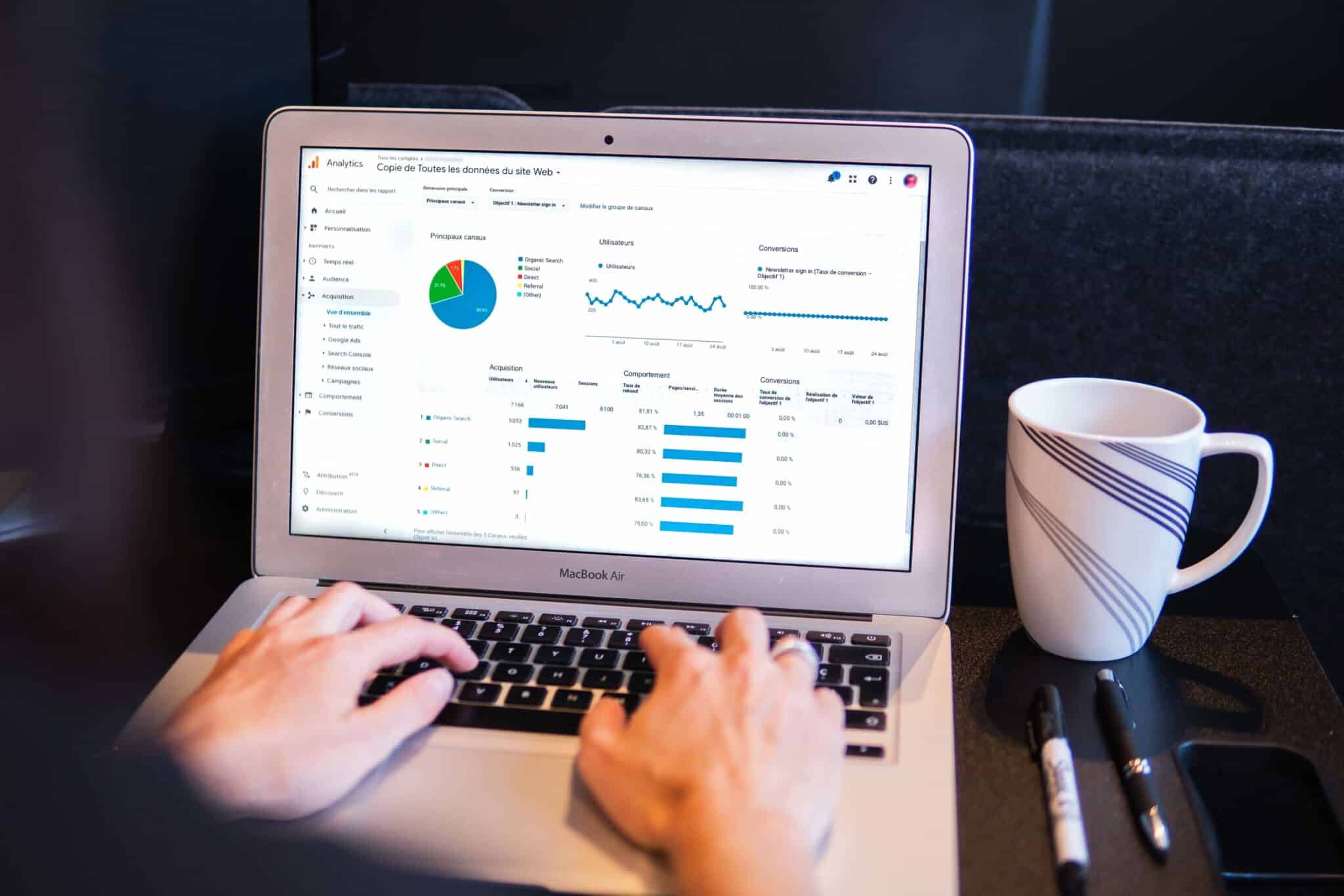

Generate Reports and Analytics

The last step in automating payroll for your tour guides is using the reporting features in your payroll software to generate comprehensive reports on payroll expenses, employee costs, and tax liabilities. These insights will help you make informed decisions regarding your workforce and financial planning.

TL;DR

Automating payroll processes for your adventure tour operations streamlines administrative tasks, reduces payroll errors, and saves you time, so you can focus on getting back outside. By selecting the right payroll software, centralizing employee data, automating time tracking, payroll and deductions, setting up direct deposit, staying compliant with legal and tax regulations, and leveraging reporting capabilities, you’ll end up saving a ton of time and money that you can put toward growing your business, making your guides happy, and building awesome adventures for clients.